Feie Calculator Fundamentals Explained

Wiki Article

The Only Guide for Feie Calculator

Table of ContentsWhat Does Feie Calculator Mean?9 Simple Techniques For Feie CalculatorThe Ultimate Guide To Feie CalculatorNot known Facts About Feie CalculatorTop Guidelines Of Feie Calculator

Initially, he sold his U.S. home to establish his intent to live abroad permanently and obtained a Mexican residency visa with his partner to help meet the Authentic Residency Examination. Furthermore, Neil protected a lasting residential property lease in Mexico, with strategies to ultimately buy a residential or commercial property. "I currently have a six-month lease on a house in Mexico that I can extend an additional six months, with the objective to buy a home down there." Nevertheless, Neil aims out that buying residential property abroad can be challenging without first experiencing the area."It's something that people need to be really thorough regarding," he says, and suggests expats to be cautious of common blunders, such as overstaying in the U.S.

Neil is careful to stress to U.S. tax authorities tax obligation "I'm not conducting any performing in Company. The United state is one of the couple of nations that tax obligations its citizens regardless of where they live, suggesting that even if a deportee has no revenue from U.S.

tax return. "The Foreign Tax Debt permits people functioning in high-tax countries like the UK to counter their United state tax responsibility by the amount they have actually already paid in tax obligations abroad," claims Lewis.

The Feie Calculator Statements

Below are some of one of the most often asked inquiries about the FEIE and various click this link other exemptions The Foreign Earned Earnings Exemption (FEIE) permits U.S. taxpayers to exclude as much as $130,000 of foreign-earned income from government income tax, lowering their united state tax liability. To get FEIE, you need to fulfill either the Physical Visibility Examination (330 days abroad) or the Authentic House Examination (prove your primary residence in an international country for a whole tax year).

The Physical Visibility Examination likewise needs U.S (American Expats). taxpayers to have both an international earnings and a foreign tax home.

A Biased View of Feie Calculator

An earnings tax treaty in between the united state and another nation can assist prevent dual taxation. While the Foreign Earned Earnings Exemption reduces gross income, a treaty may supply extra advantages for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a called for declare U.S. residents with over $10,000 in international economic accounts.Eligibility for FEIE depends on meeting certain residency or physical existence examinations. He has over thirty years of experience and now specializes in CFO solutions, equity settlement, copyright tax, marijuana tax and divorce related tax/financial planning issues. He is an expat based in Mexico.

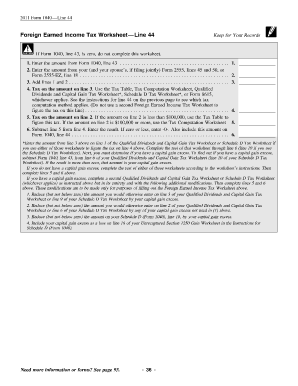

The international earned income exemptions, occasionally described as the Sec. 911 exclusions, exclude tax obligation on earnings made from working abroad. The exemptions make up 2 parts - a revenue exemption and a housing exemption. The following Frequently asked questions review the benefit of the exclusions consisting of when both spouses are deportees in a general fashion.

Some Known Facts About Feie Calculator.

The revenue exclusion is currently indexed for inflation. The maximum yearly income exemption is $130,000 for 2025. The tax obligation benefit omits the revenue from tax at lower tax rates. Previously, the exemptions "came off the top" reducing earnings topic to tax at the leading tax obligation prices. The exclusions may or might not reduce earnings utilized for various other purposes, such as IRA limitations, youngster credit ratings, individual exceptions, and so on.These exemptions do not spare the earnings from United States taxes but merely give a tax reduction. Note that a bachelor functioning abroad for every one of 2025 that gained concerning $145,000 without various other earnings will certainly have gross income reduced to zero - efficiently the same answer as being "free of tax." The exemptions are computed daily.

Report this wiki page